BBC Sport explores Everton’s record spending in the summer window and how the new arrivals have helped them make an impressive start to the season.

Jailed Akins named on Mansfield squad list

Jailed footballer Lucas Akins is included in Mansfield Town’s squad list this season and will be free to restart his career when released.

How Hodgkinson found strength in ‘most challenging year’

Britain’s Keely Hodgkinson aims to add the world 800m title to her Olympic gold in Tokyo.

‘Age is just a number’ – Vardy begins life in Italy

Former Leicester striker Jamie Vardy says “age is just a number” as he opens a new chapter of his career with Italian side Cremonese.

‘Enhanced Games prize money worth 13 world titles’

Ben Proud says it would take “13 years of winning a World Championship title” to match the money on offer for winning a race at the Enhanced Games.

Chelsea face 74 charges over agent payments

Chelsea are charged by the Football Association with 74 alleged rule breaches related to payments to agents when Roman Abramovich was owner.

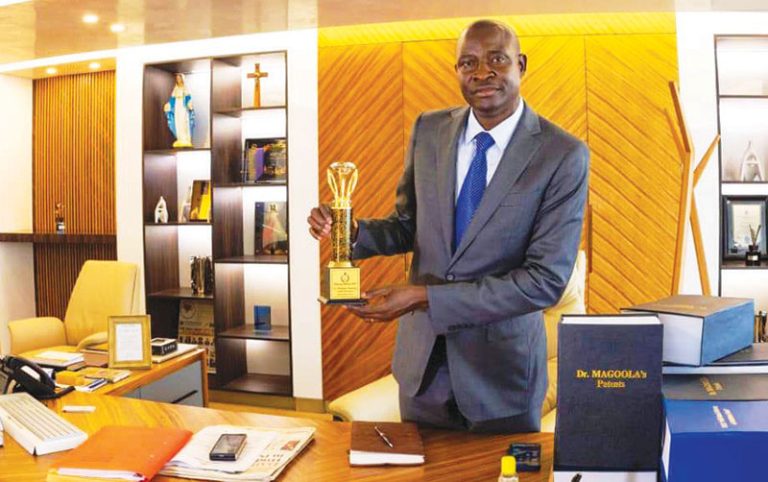

From Uganda to Canada: Magoola bags top global science honor

From Uganda to Canada: Magoola bags top global science honor appeared first on The Observer.

From Uganda to Canada: Magoola bags top global science honor appeared first on The Observer.

Ssenfuka hails Museveni’s support: Can Uganda get cancer, diabetes cure?

Ssenfuka hails Museveni’s support: Can Uganda get cancer, diabetes cure? appeared first on The Observer.

Ssenfuka hails Museveni’s support: Can Uganda get cancer, diabetes cure? appeared first on The Observer.